Reviews

Buy a used car between 15th - 22nd April

and enjoy a free gift!

Get a free valuation in 30 seconds.

Our finance rates start at 8.9% APR representative across our used car range. And there are no hidden fees - the price you see is the price you pay.

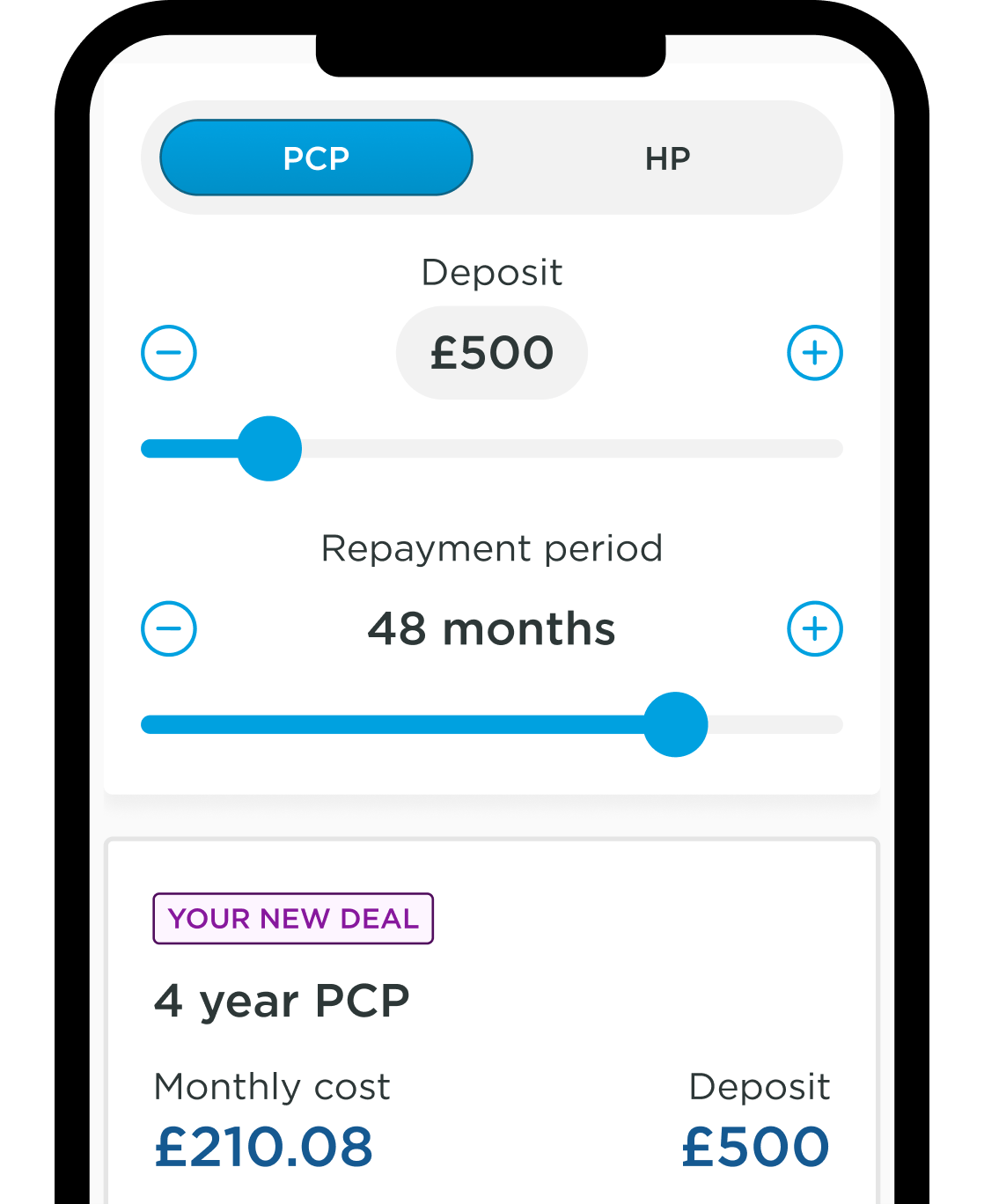

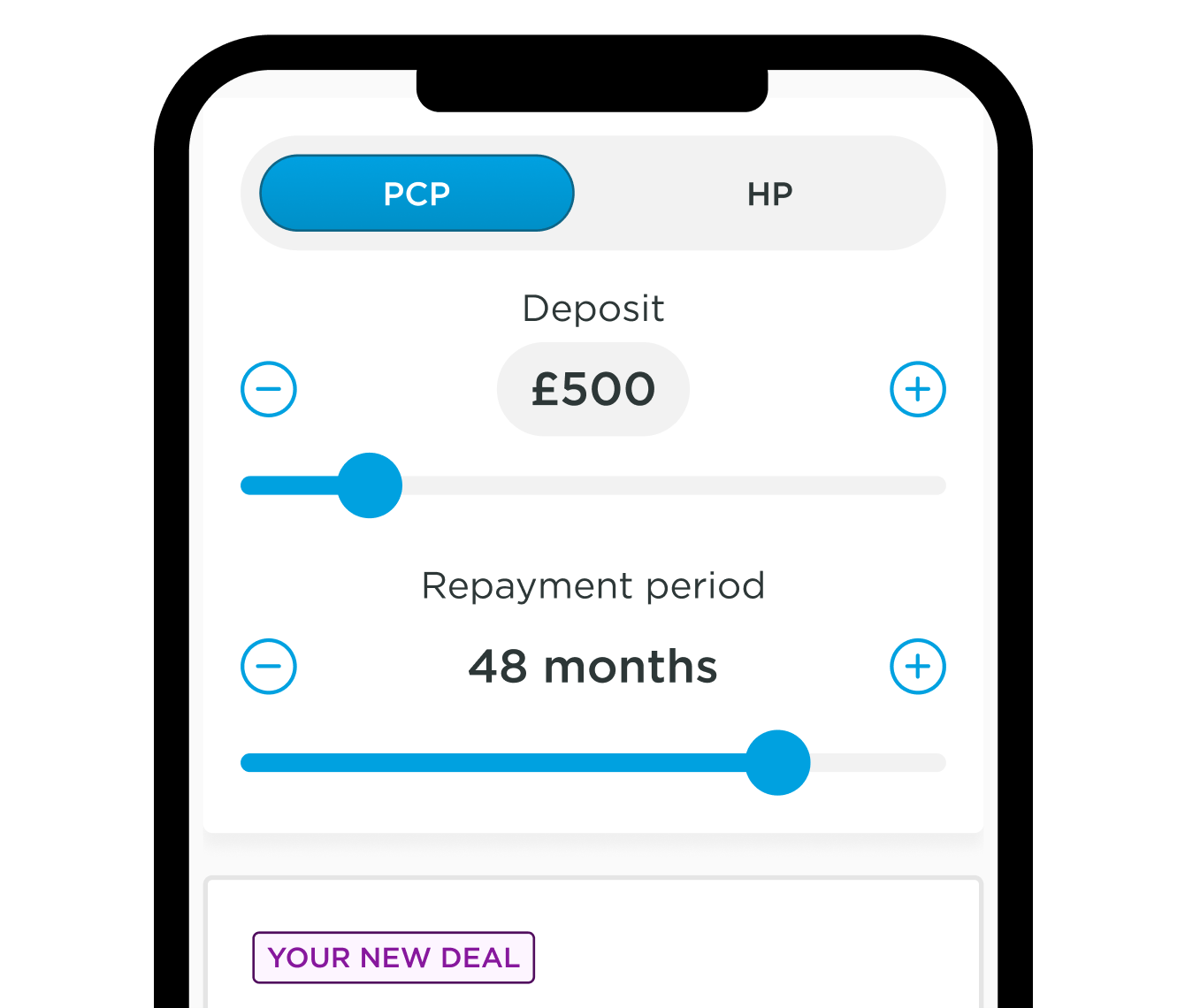

Customise your finance quote to suit your budget. Choose your finance type, deposit, term and annual mileage allowance.

PCP is perfect for drivers who:

At the end of the agreement you have a few options:

PCH benefits drivers who:

At the end of the agreement:

HP is ideal for drivers who:

At the end of the agreement:

Still not sure which finance option is best for you?

Find out more

We can help you to work out the ideal time to change your car - pop into a branch and speak to one of our product consultants. Some of our lenders may be willing to underwrite this type of finance, either as an unsecured personal loan or a hybrid finance arrangement, where the car is on a secured agreement but the negative equity on a personal loan.

You simply need your debit or credit card (to pay the initial deposit) and your driving licence, as a form of identification.

That doesn't necessarily mean you won't be able to arrange a finance deal with us. We work with more than 20 lenders to find the right finance package. Just let us know if you know you have a poor credit score, and we will try to match you with the most appropriate lender. Speak to one of our product consultants for more information.

You pay an initial deposit, followed by monthly payments. At the end of your payments, a final larger payment remains. You can either pay this to keep the car, part-exchange for a new car, or hand the car back.

You take control of the car for a contractual period and make fixed monthly payments. When the contract expires, you return the car, or take out a contract on a new one.

You pay an initial deposit, followed by monthly payments which are set by you. Once the final payment is made, the HP contract ends and you own the car.

Reviews

Arnold Clark Automobiles Limited is authorised and regulated by the Financial Conduct Authority for general insurance and consumer credit purposes. We act as a credit broker sourcing credit to assist with your purchase from a carefully selected panel of lenders. Lenders will pay us a fee for these introductions (click here for details including our panel of lenders and disclosure statement). Offers subject to status, terms and conditions.